Sarkar Office Japan KK

Consulting & Administrative Legal Services

Japan "One-Stop Solution" Since 1993

Branch, Subsidiary Company (KK, GK) Registration

Statutory Compliance (Tax, Social Insurance, etc.)

Consulting & Administrative Legal Services

Japan "One-Stop Solution" Since 1993

Branch, Subsidiary Company (KK, GK) Registration

Statutory Compliance (Tax, Social Insurance, etc.)

Japan Individual (Personal) Tax System – Brief Summary

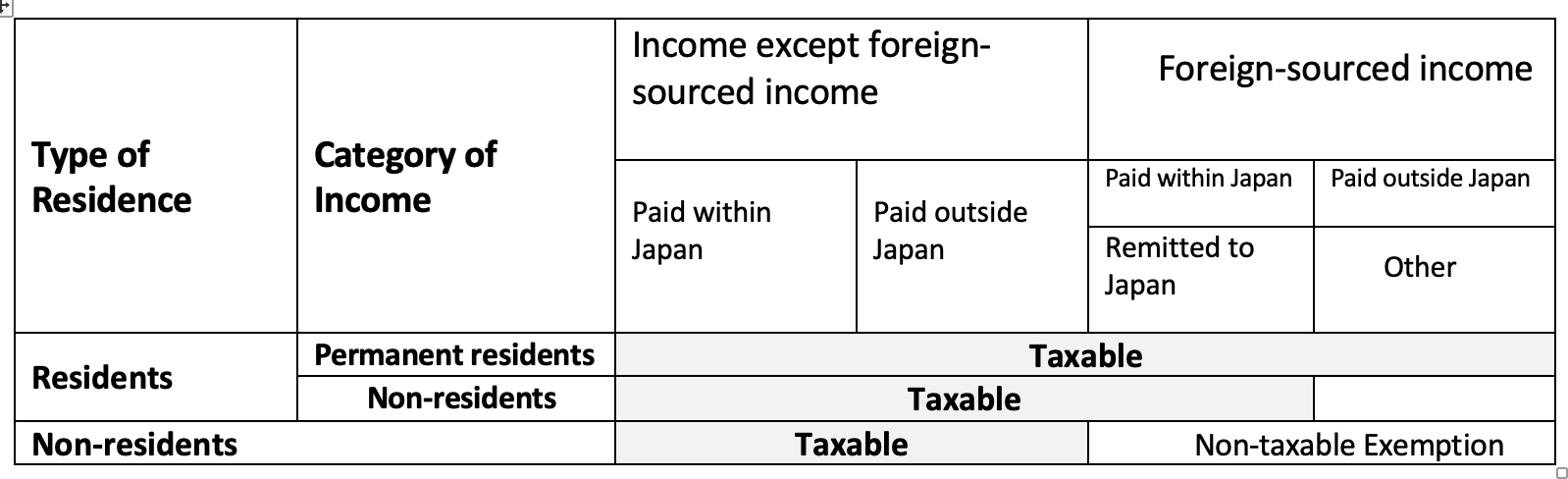

Everyone living in Japan, irrespective of nationality, is classified as "Residents" or "Non-residents. "Individual income tax comprises "self-assessed income tax" and "withholding income tax" and is levied on the individual's income for the "calendar year."

Residents: Persons with a domicile (principal base and centre of one's life) in Japan and persons who have resided in Japan for one year or more are termed residents. Residents' worldwide income, regardless of the location of the source of income, is subject to income tax.

Non-permanent residents: Residents with no Japanese citizenship and domicile or residence in Japan for five years or less within ten years are non-permanent residents. The scope of taxation for non-permanent residents corresponds to that for residents. Still, tax will not be assessed in Japan on income sourced outside Japan as long as that income is not paid within Japan or is not remitted to Japan. However, the salary paid based on the work in Japan applies to domestic-sourced income even if it is paid outside Japan, and income tax will be assessed by summing the salary paid within and outside Japan.

Non-residents: Persons not qualifying as residents are termed non-residents. Japanese income tax for non-residents will be assessed on income sourced within Japan.

Scope of personal taxable income

Self-assessed income tax

Self-assessed income tax on residents: Income is calculated using methods established for each of a number of income classifications. The tax is calculated by subtracting the various income deductions from the total amount of income and then multiplying the difference, which is the amount of taxable income, by the progressive tax rates below. Any withholding income tax levied on the income beforehand will be deducted from the calculated tax.

Self-assessed income tax on non-residents: Non-residents are classified by their circumstances into (a) non-residents having an office, etc., in Japan, (b) non-residents continuously engaged in construction or assembly in Japan for one year or more, or doing business through a designated agent in Japan, or (c) other non-residents.

Taxable income is calculated within the scope of income established for each classification. The method of taxation for non-residents will also change in terms of income tax pertaining to 2017 or later. The amount of self-assessed income tax levied on non-residents is, as a rule, calculated in the same manner as for residents (subject to certain limits such as non-application of applicable income deductions and foreign tax deductions). Non-residents who earn salary income paid for services provided in Japan and not deemed subject to withholding tax in Japan must file a individual tax return and pay a 20.42% tax on the total amount of that salary.

Withholding Tax:

Employers in Japan are required to withhold income tax from their employee's salaries and remit it to the tax authorities on their behalf. This withholding tax system helps simplify the tax process for individuals and ensures that taxes are paid on time. Additionally, individuals with income of more than 20M yen or from multiple sources or self-employment are required to file a "white/blue form" tax return to report their income and calculate their tax liability.

Tax Return-Filing (Personal Income Tax)

In Japan, individuals must file a tax return between February 16 and March 15 of the following year. The tax return must include details of all sources of income, deductions, and tax credits. Failure to file a tax return or underreporting income can result in fines and penalties from the tax authorities.

For Personal Tax Return filing and other matters related to Personal Tax, please get in touch with us with a detailed inquiry via Email.

For further information, please contact us by mail

We accept Credit Card Payment

Payment Link:

Types of Companies in Japan (Business Establishment)

Japanese Company (KK or GK) Incorporation

Kabushiki Kaisha (KK) Opening Form & Documents

Godo Kaisha (GK) Opening Procedure, Steps and Flow Chart

Godo Kaisha (GK) Opening Form & Documents

Japan Branch Office Opening Form & Documents

Japan Subsidiary Company Closing Steps and Procedure

Proprietorship Business Closure

Corporate Number (NTA)

Japan Tax (NTA)

Income Tax Guide (NTA)

My Number (Japan)

Social Insurance (Japan)

Immigration Bureau (Japan)

Japan Visa (MOFA)